Selecting stocks that benefit the world

We take a highly customized approach to creating investment portfolios with sustainability integrated at every step. We begin by listening to each client to gain a clear understanding of their financial goals and priorities for sustainable investing. We then select stocks that align with those objectives, based on a careful analysis of each company’s environmental, social and governance (ESG) performance. We actively engage with companies we are invested in.

Positive approach

While some sustainable investment strategies emphasize what not to invest in, we take a positive approach—proactively seeking out large- and mid-cap companies that align with our clients’ values and sustainable investing goals. We monitor the companies we invest in and reassess our investment in cases of a major ESG-related event or change in direction.

Multi-dimensional analysis

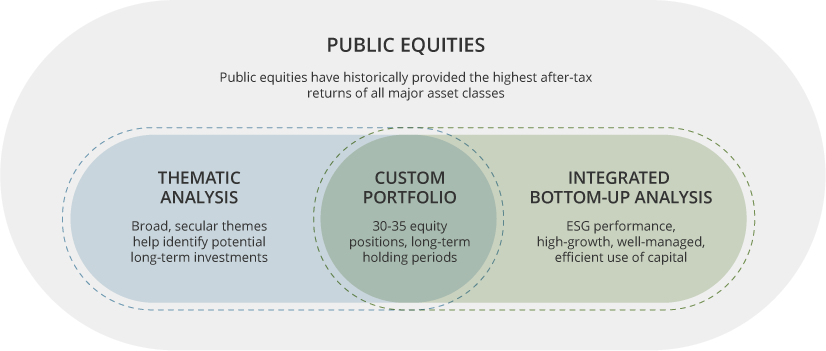

We structure portfolios around broad sustainability themes with the greatest potential for sustainable growth into the future. We focus on high-quality growth companies, performing both thematic and bottom-up analyses, paying careful attention to ESG factors that are often not captured on balance sheets.

Long-term view

We emphasize long-term holding periods for a select portfolio of stocks. This is not only more tax-efficient, but also enhances our ability to influence corporate ESG strategies through our shareholder engagement activities.

Our stock selection process